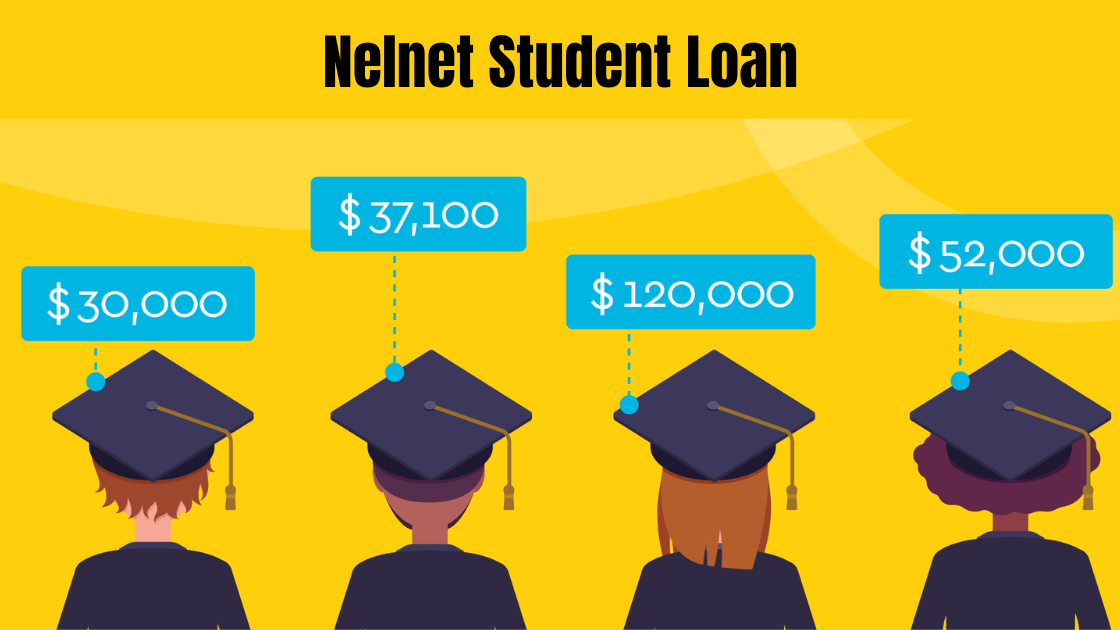

As a new student, navigating the world of student loans can be overwhelming and confusing. Many different options are available, each with its unique set of terms, conditions, and repayment options. This article will provide you with a comprehensive guide to Nelnet student loans to make an informed decision about which loan is right for you.

Nelnet is a student loan servicer based in Lincoln, Nebraska. Nelnet is a student loan servicing company specializing in consumer finance, telecommunications, and K-12 and higher education. It is the private student loan division of Nelnet that provides services such as student loan deferment and refinancing. Nelnet Federal Student Loan Services is the division of Nelnet that provides federal loan services and support to the Department of Education. As of March 31, 2020, Nelnet was servicing $185.5 billion of student loans for 5.5 million borrowers. Top of Form

What Kind of Loans Does Nelnet Offer?

Nelnet is a private student loan lender that offers a variety of loan options for undergraduate, graduate, MBA, law, or advanced health professional degrees. Nelnet also provides student loan refinancing for these types of degrees and private student loans. In addition to personal student loans, Nelnet manages and assists with repaying federal student loans. The company provides multiple student loan repayment plans, including standard, graduated, extended, income-sensitive, and income-driven payment plans. Nelnet also offers several borrower benefits, such as discounted interest rates for auto-debit payments and the option to release a cosigner after 24 consecutive on-time payments. Nelnet provides a variety of student loan options.

Federal Direct Loans

Federal Direct Loans provide to the federal government and are the most common type of student loan. They are available to all eligible students, regardless of their financial situation. Direct Loans are available in two forms: Subsidized and Unsubsidized. Subsidized loans base on financial need, and the government pays the interest while the borrower is in school. On the other hand, unsubsidized loans accrue interest while the borrower is in school, and the borrower is responsible for paying the interest.

Federal Family Education Loans (FFEL)

Federal Family Education Loans (FFEL) provide to private lenders but guarantee by the federal government. Like Direct Loans, FFEL loans are available in both Subsidized and Unsubsidized options.

Private Student Loans

Private student loans provide by private lenders and are never guaranteed federal government. They are typically used to cover the cost of attendance when federal loans are not enough.

Repayment Options

Nelnet offers several repayment options to help make your student loan payments more manageable. The extended repayment plan allows borrowers to choose between standard payments (equal payments over the payment term) or graduated payments (payments that increase every two years). The income-sensitive repayment plan is only available for FFELP loans and has an annual adjustment to the minimum monthly payment based on the borrower’s monthly gross income.

Standard Repayment Plan

The Nelnet Student Loan Standard Repayment Plan is a typical loan repayment plan that requires equal monthly payments over the loan term, typically ten years. This plan is usually the most economical option and qualifies for Public Service Loan Forgiveness (PSLF) program. If borrowers do not choose a different repayment plan, they will give the Standard Repayment Plan by the lender.

Graduated Repayment Plan

The Graduated Repayment Plan allows you to make lower payments at the beginning of your repayment term and gradually increase the costs over time. The monthly installment payment varies throughout the repayment period. The Graduated Repayment Plan is one of several options Nelnet provides for student loan repayment. Read about Things to Know Before Taking out Student Loans.

Income-Driven Repayment Plan

The Nelnet student loan income-driven repayment plan is a federal repayment plan provided by the U.S. Department of Education. President Biden announced an extension of the relief measures for federal student loans owned by the U.S. Department of Education, and borrowers will not be required to make monthly payments. Interest rates will be at 0% until the payment pause ends. To be eligible for the plan, borrowers must make 120 on-time qualifying payments or receive credit for fees. It is in a qualifying repayment plan such as Revised Pay as You Earn, Income-Based Repayment, Pay As You Earn, or Income-Contingent Repayment.

Extended Repayment Plan

This plan caps monthly payments at 5% of the borrower’s monthly income and eliminates the remaining balance after ten years if the original loan balance was $12,000 or less. Nelnet offers several loan repayment options, including ways to lower payments and Income-Driven Repayment Plans, such as IBR, PAYE, and REPAYE, which help borrowers afford their monthly student loan payments and provide a path to debt freedom.

Loan Forgiveness Programs

Nelnet also offers loan forgiveness programs for eligible borrowers. Different student loan forgiveness programs are available to qualified borrowers, such as the Public Service Loan Forgiveness (PSLF) program. PSLF is a federal student loan forgiveness option available for borrowers with direct loans, which MOHELA now manages. To qualify for PSLF, borrowers must meet specific criteria and eligibility requirements, including working full-time for a government agency or training nonprofit organization.